The Growing Significance of Impact Investment

Jul 29, 2024

The world of investment is evolving, with a significant shift towards impact investment. This approach not only seeks financial returns but also aims to generate positive, measurable social and environmental impacts. In our recent podcast episode, we had the pleasure of discussing this transformative investment strategy with Ahmed Fadl, from Village Capital. In this article, we will explore the core principles of impact investment, its growth, and how it is shaping the future of finance.

Understanding Impact Investment

Impact investment is a strategy that aligns financial returns with social and environmental benefits. It addresses global challenges such as sustainable agriculture, renewable energy, conservation, microfinance, and affordable and accessible basic services including housing, healthcare, and education. The primary objective is to create a measurable positive impact while generating financial returns.

The Rise of Impact Investment

The concept of impact investment has gained substantial traction over the past decade. According to the Global Impact Investing Network (GIIN), the impact investing market has grown from $52 billion in assets under management in 2010 to over $715 billion in 2020. This rapid growth indicates a rising awareness and commitment among investors to address global challenges through their investment choices.

Key Principles of Impact Investment

Intentionality: Investors intentionally seek to create positive social or environmental impact through their investments.

Investment with Return Expectations: Investments are expected to generate a financial return on capital.

Range of Return Expectations and Asset Classes: Impact investments generate returns that range from below market to market rate and can be made across various asset classes.

Impact Measurement: A core characteristic of impact investing is the commitment to measure and report the social and environmental performance and progress of underlying investments.

Impact Investment: Market Growth and Trends

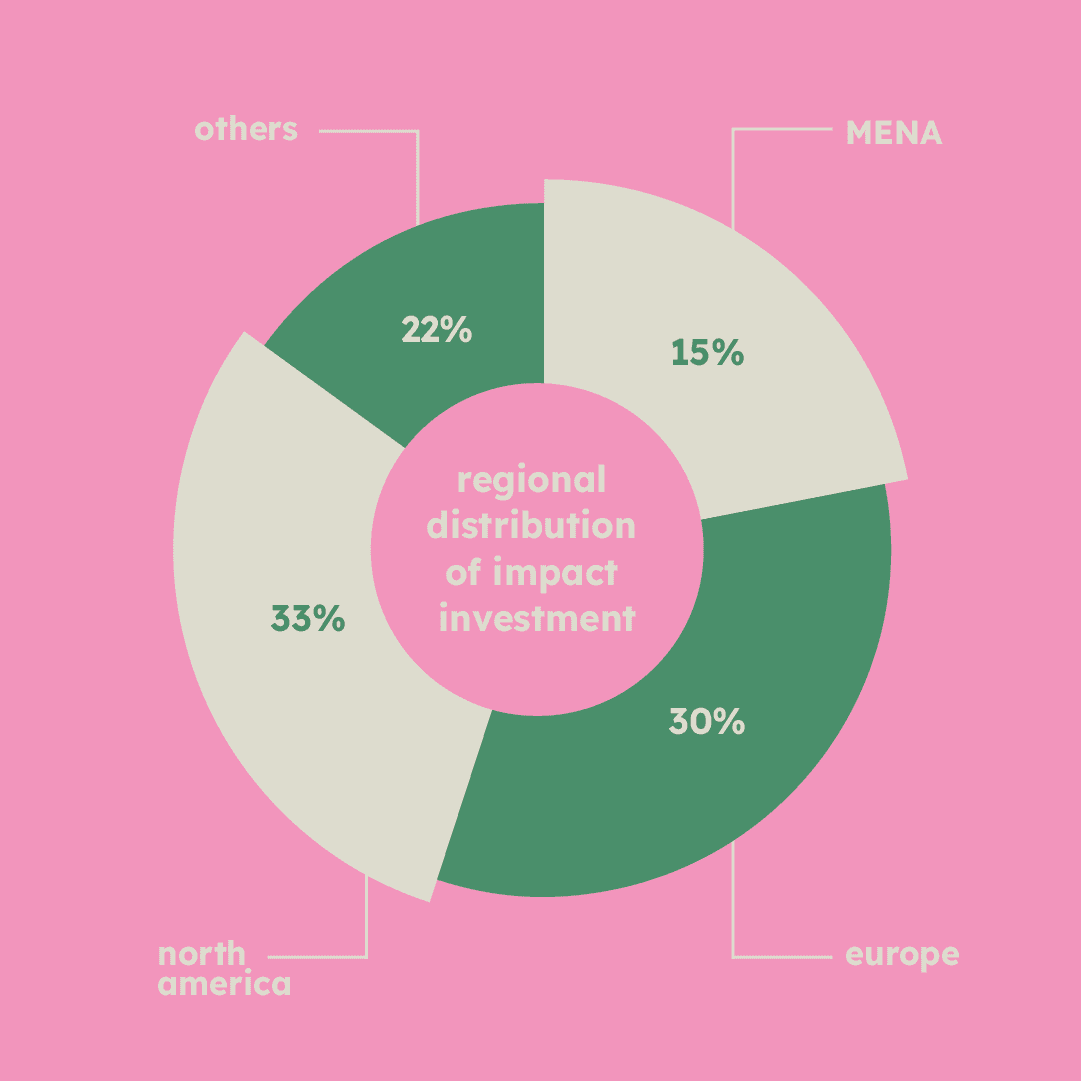

Impact investment is gaining momentum globally, with significant growth observed in regions such as North America, Europe, and the MENA region. The following data highlights the market growth and trends:

Global Impact Investing Network (GIIN) Survey 2020:

Market Size: $715 billion in assets under management.

Investor Types: The market comprises diverse investors, including fund managers, foundations, banks, development finance institutions, family offices, and pension funds.

Sectors: Major sectors attracting impact investment include energy, microfinance, housing, and financial services.

Regional Growth:

North America: 33% of global impact investments.

Europe: 30% of global impact investments.

MENA Region: Growing interest in investments in renewable energy, education, and healthcare.

Challenges and Opportunities

While the growth of impact investment is promising, it is not without challenges. These include:

Impact Measurement: Ensuring accurate and consistent measurement of social and environmental impact remains a challenge. Standardized metrics and frameworks are essential for comparability and accountability.

Market Development: Developing robust impact investment markets requires supportive regulatory environments, investor education, and collaboration among stakeholders.

Scalability: Scaling impact investments to address large-scale global challenges requires substantial capital and innovative financial instruments.

Despite these challenges, the opportunities are immense. Impact investment has the potential to drive significant positive change by addressing critical issues such as climate change, poverty, and inequality. Investors are increasingly recognizing that generating financial returns and creating positive social and environmental impact are not mutually exclusive goals.

Join the Conversation

Our recent podcast episode with Ahmed Fadl delves deeper into the nuances of impact investment, exploring its growth, challenges, and future prospects. Ahmed shares valuable insights and real-world examples, making it a must-listen for anyone interested in the intersection of finance and social impact. Listen on all platforms: Here

We invite you to check out the episode and join the conversation on how we can harness the power of impact investment to create a better world. Stay tuned for more thought-provoking discussions and insights from industry leaders.